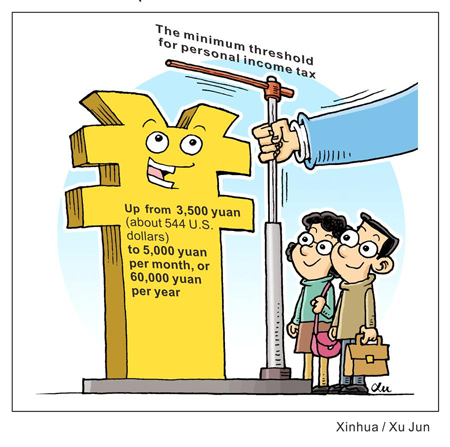

This cartoon shows that China will raise the minimum threshold for personal income tax from 3,500 yuan (about 544 U.S. dollars) to 5,000 yuan per month, or 60,000 yuan per year, as proposed by China's top legislature in a draft amendment to the Individual Income Tax Law on Tuesday. (Xinhua/Xu Jun/Shi Manke)

China's top legislature Tuesday began reviewing a draft amendment to the Individual Income Tax Law as part of efforts in the country to achieve fairer income distribution and common prosperity.

The draft amendment, submitted for the first reading at a bimonthly session of the National People's Congress (NPC) Standing Committee, raises the minimum threshold for personal income tax from 3,500 yuan (about 544 U.S. dollars) to 5,000 yuan per month, or 60,000 yuan per year.

This standard will also be applicable to those who have no domestic residence but receive an income from wages in China, as well as those who live in China but receive an income from overseas wages.

REVISIONS FOR CONTINUING REFORM

Entrusted by the State Council, Finance Minister Liu Kun told lawmakers at Tuesday's opening of the session that the revisions are aimed at implementing decisions by central authorities and ensuring a smooth individual income tax reform in accordance with the law.

"With this year marking the 40th anniversary of reform and opening up, the revisions focus on content that is no longer suitable for China's continuing reform," Liu said, adding that the changes have taken people's rising consumption expenses into account.

The draft amendment adds special expense deductions for items like children's education, continuing education, treatment for serious diseases, as well as housing loan interest and rent.

"This is the first time that special expense deductions have been introduced in China's individual income tax system," Liu said, adding that they adhere to the basic principles of individual income tax and are helpful for a fair taxation system.

The changes are conducive to reducing tax burdens for taxpayers, raising people's income and boosting consumption.

The amendment defines resident individuals and non-resident individuals as two types of taxpayers. In addition, the length of time used to distinguish between the two groups will be adjusted to 183 days from the previous 365.

"This will help establish tax jurisdictions and safeguard national tax rights and interests," Liu said.

The individual income tax was the third major contributor to China's total tax revenue, following value-added tax and enterprise income tax. In 2017, China collected individual income taxes worth nearly 1.2 trillion yuan, about 8.3 percent of the total tax revenue.