Pedestrians walk past a cross-border financial advertising board in Hong Kong on Jan 20, 2022. [(ZHANG WEI/CHINA NEWS SERVICE)

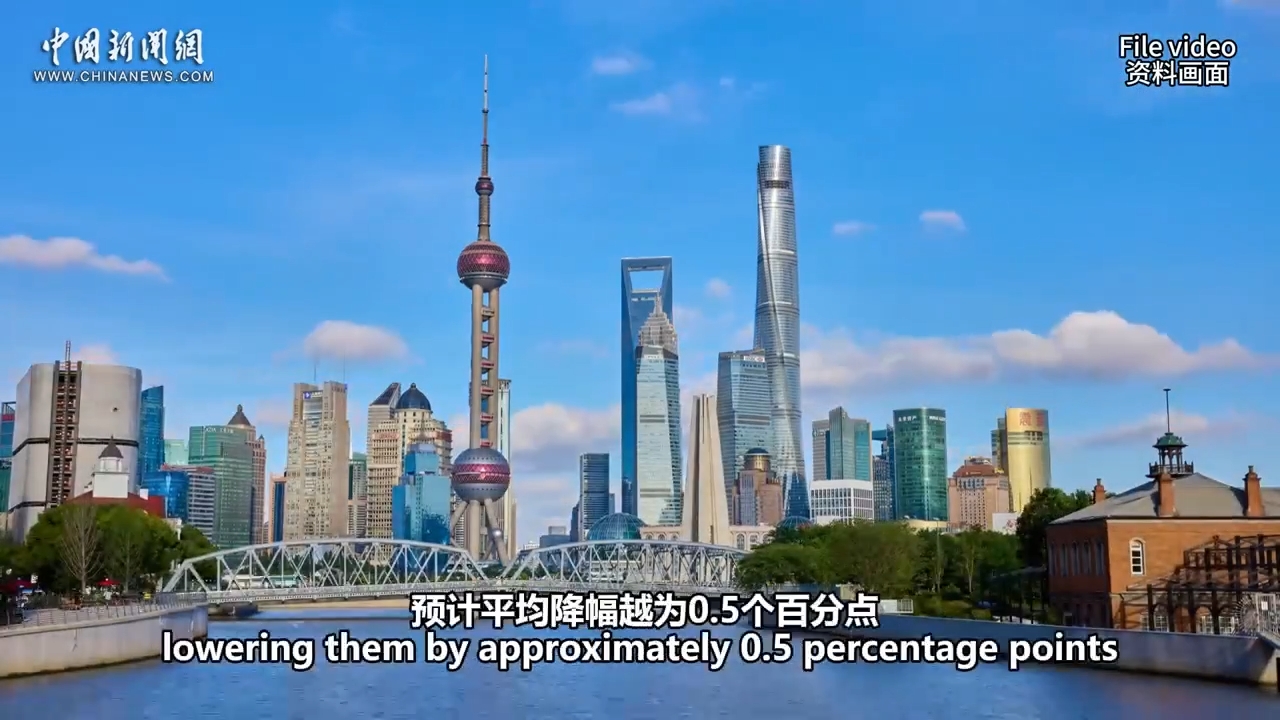

Chinese people's increasing interest in diversifying investments on a global scale has attracted rising attention from both policymakers and financial services providers.

An HSBC Group survey showed that Chinese mainland investors' willingness to allocate their assets globally has been on the rise this year compared to 12 months ago. About 52 percent of Chinese mainland interviewees said they will increase their investments in overseas markets.

Echoing HSBC's finding is Freeman Tsang, head of intermediaries at Pictet Asset Management Asia excluding Japan.

Chinese people's rising willingness to invest overseas can be seen in their surging distribution businesses over the past few months, said Tsang.

Qualified domestic institutional investors and qualified domestic limited partners, both of which link Chinese investors with overseas markets, provided more evidence of such a trend. Upon exhausting the previously approved quota, such applications have continued, he said.

Given the fact that China has been lowering interest rates, with the deposit rate currently slightly above 1 percent, people have been considering other opportunities offering higher yields, said Tsang.

As a result, Pictet has seen its cross-border wealth management and mutual recognition of funds (MRF) activity expand significantly over the past few months, he said.

The Cross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area, which started in September 2021, was upgraded in February by lowering the threshold for retail investors, expanding the scope of investable products and lifting the allowable investment ceiling. Only four months after the upgrade, the Hong Kong Monetary Authority announced plans of another revision on available products, quotas and sales processes.

The Hong Kong financial regulator's ambition did not appear out of nowhere.

Tsang said market demand for Cross-boundary WMC, allowing GBA-based Chinese mainland investors to access the Hong Kong and Macao capital markets, was moderate at the very beginning. The program recorded a total 15.2 billion yuan ($2.15 billion) of capital flow both at the northbound and southbound ends at the end of February, according to the Guangdong provincial branch of the People's Bank of China, the country's central bank.

The number quickly spiked to 83.5 billion yuan as of the end of July, increasing by more than fourfold compared to the figure in February, with the majority of capital flows entering Hong Kong and Macao via the southbound leg.

One month after the upgrade, an additional 24,288 individual investors in the GBA signed up for the Cross-boundary WMC, surging 9.16-fold on a monthly basis, according to the PBOC's Guangdong branch.

International lenders have responded quickly. HSBC has provided over 100 funds under the southbound leg of the connect program, under which Chinese mainland investors can access overseas markets. Standard Chartered has introduced about 550 products under the southbound leg while DBS has launched over 220 wealth management products for Chinese mainland investors.

"The regulator will not discuss further opening-up of the institutional arrangement if there is no surging demand," said Tsang.

MRF, which was launched in July 2015, is another example.

Under MRF, Hong Kong-domiciled funds are available to Chinese mainland investors, and vice versa. According to the current regulations, a maximum 50 percent of assets under management of funds sourced from Hong Kong can be sold to Chinese mainland investors. An identical cap has been set for the other direction of the MRF.

But the China Securities Regulatory Commission, the nation's top securities watchdog, released a draft version of the revised MRF regulations in June, planning to raise the limit to 80 percent. In this sense, Chinese mainland investors tapping into the Hong Kong capital market will be provided with more options.

Although the draft regulations are still awaiting finalization — which market mavens expect to take place in the fourth quarter — Pictet is already benefiting. With Tianhong Asset Management as its local partner on the Chinese mainland, the number of sub-distributors has tripled over the past three months, said Tsang.

International institutions plan to introduce more Hong Kong-domiciled products to benefit from the upgraded MRF arrangement, and Pictet is no exception, he added.

"We strengthened our investment team earlier this year by hiring a new senior investment manager in Hong Kong. Given the huge development potential of MRF, we also plan to introduce an Asian US dollar bond strategy fund to MRF. Meanwhile, we will continue to expand our Hong Kong-domiciled product range," Pictet said.

京公網安備 11010202009201號

京公網安備 11010202009201號