The China Securities Regulatory Commission released four sets of guidelines on Friday to strengthen market supervision, aimed at effectively enhancing the quality of listed companies and better safeguarding investor interests.

Experts said the move showcases the regulator's commitment to taking swift action to fulfill its promise of creating a fairer marketplace for smaller investors, conducive to sustaining the recent rally in the A-share market.

The documents detailed measures to strengthen the supervision of the process of getting listed and issuing stocks, intensify the oversight of listed company behaviors, enhance the expertise of securities firms and mutual fund companies, and crack down on any instances of misconduct and corruption among CSRC officials.

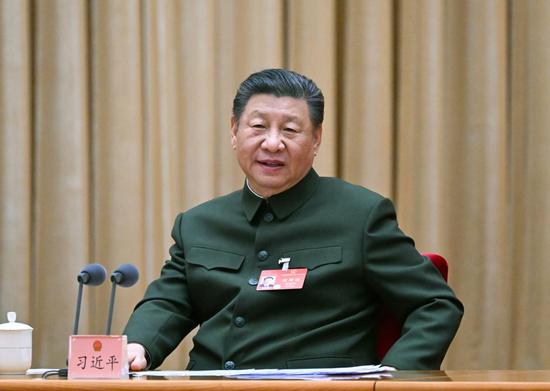

Li Chao, vice-chairman of the CSRC, said at a news conference on Friday that the documents are aligned with the principles of strengthening regulation, preventing risks and promoting high-quality development.

"On the one hand, the guidelines focused on improving the quality of listed companies and better protecting the legitimate rights and interests of investors, and further refined measures to strengthen market supervision."

On the other hand, Li said the guidelines also made comprehensive arrangements to strictly enhance the CSRC's internal management to strengthen self-scrutiny and confront tough issues head-on.

Specific measures unveiled by the guidelines include adjusting the pace of new stock issuance in accordance with the secondary market's capacity to absorb new shares, raising the financial listing criteria of some market sections and increasing on-site inspections of IPO applicants.

Yan Bojin, head of the CSRC's department of public offering supervision, said the commission will guide the Shanghai and Shenzhen bourses to moderately tighten the financial listing criteria of certain market sections so that companies at different stages of development can get listed in suitable sections.

Yan, who is also the commission's chief risk officer, said on-site inspections of the companies under IPO reviews will also be significantly increased to cover no less than one-third of the applicants.

Activities of fraudulent issuances and financial frauds detected during on-site inspections would be strictly punished, even if the companies withdraw their listing applications, Yan said.

The new guidelines also specified measures to encourage listed companies to increase dividend payouts and strengthen market value management while cracking down on big shareholders reducing holdings illegally.

Friday's move came in as part of China's ramped-up efforts to clamp down on illegal market behaviors and ensure a fair environment for retail investors, including suspending the lending of restricted shares.

"Protecting the lawful rights and interests of investors, especially small and medium-sized investors, is the most important and central task of the CSRC," Wu Qing, chairman of the CSRC, said last week during the annual gathering of the country's top legislature.

China's A-share market has recovered from its recent slump amid strengthened policy support as the benchmark Shanghai Composite Index has rebounded by about 13 percent from its trough in early February and rose 0.54 percent to 3,054.64 points on Friday.

Liu Jiawei, an analyst at Dongxing Securities, said the continuous regulatory efforts will work in tandem with more proactive fiscal and monetary policies in creating a virtuous cycle among policy support, market performance and investor sentiment.

京公網(wǎng)安備 11010202009201號

京公網(wǎng)安備 11010202009201號